By John Benjamin: Last updated 10/29/2023

ETFs have become a common investment option for many retail and institutional investors. Most retail investors have exposure to ETFs via investment accounts or retirement accounts. Although there are many automated options for investors these days including letting your advisor decide how you invest. Investors should have an understanding of how to value ETFs. Like any investment, you want to get a decent return. Well, to generate a decent return you need to buy at an appropriate price. As the old saying goes, the idea is to buy low and sell high and ETFs are no different.

When it comes to ETF’s the NAV (Net Asset Value) is what investors should look to, to determine the value of the ETF. Because many ETFs could be made up of hundreds of stocks, cash, and other securities calculating the value can be tricky. This article will attempt to simplify determining the NAV of ETFs. First, we will cover what NAV is, how it’s calculated, and why it’s important. After that, we will cover other important ETF valuation metrics.

What is NAV?

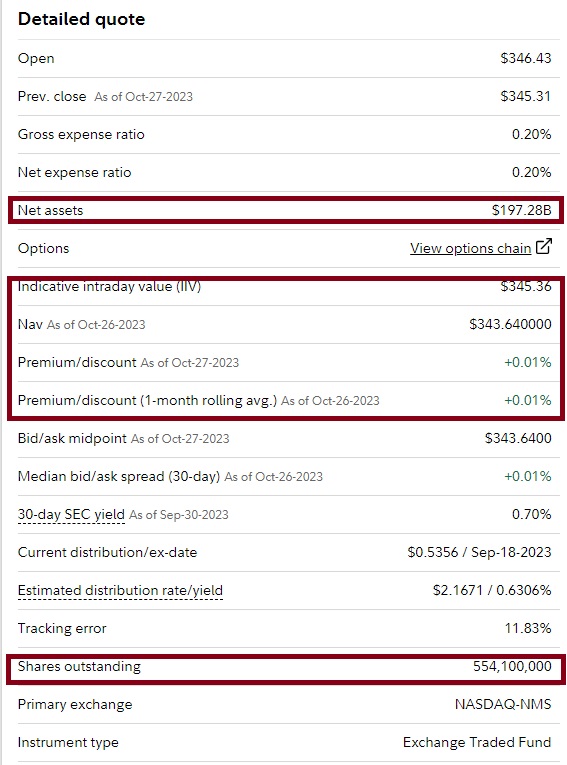

So, what exactly is NAV? When it comes to ETFs NAV can represent either the total value of all assets minus its liabilities or it can reference the per-share value. The per-share value uses the same amounts as above but takes the equation a step further and divides it by the ETF shares outstanding. In this post, NAV will reference the per-share value. You can find the NAV listed with other important data when you look up a quote. One thing you will notice when looking at the ETF quote is that there is a slight difference between the NAV and the price quoted. We will go into this difference in later sections.

Why is NAV important?

The Importance of NAV should not be understated. Let’s look at a few reasons why NAV is important. We have already discussed and will continue to discuss the main reason, valuation. NAV will help investors determine the per-shear value of the ETF. Knowing the per-shear value does a couple of things for investors. 1. Allows you to make better, more informed buy and sell decisions, 2. Gives you a way to measure the performance of the ETF and compare its performance to other ETFs. The last reason I will give you why NAV is important is the Cost. Whether it is calculating your capital gain tax or calculating the fees and expenses you will pay. NAV is a critical part of both calculations.

How to Calculate NAV?

So how do you calculate the NAV? According to Abner (2016), The NAV of the ETF is calculated by taking the sum of the assets in the fund, including any securities and cash, subtracting out any liabilities, and dividing that by the number of shares outstanding. Asset values include the previous day’s market-close value of all the securities (stocks, bonds) and cash held by the fund. Liabilities include fees and expenses. The outstanding shares portion of the calculation is a bit self-explanatory. It’s the total number of ETF shares available for trading. Below you will find the equation described above.

NAV = (Total Assets – Total Liabilities) / Total Number of Outstanding Shares

Be mindful, that the price you see an ETF trading at is not the NAV but a market price determined by the market. Most of the time the market price is very close to the NAV unless there are special circumstances present within the market or the fund is designed to operate this way

Other Notable ETF Valuation Metrics

When reviewing an ETF quote there are a few additional valuation metrics to keep in mind. There is the Premium/Discount metric. Which lets you know how the ETF is trading relative to its NAV. When ETFs trade above their NAV the ETF is viewed by the market as trading at a premium. When ETFs trade below their NAV it’s viewed by the market as trading at a discountt.

The other notable valuation metric to keep an eye on is the IIV (Intraday Indicative Value), iNAV and IOPV (Indicative optimized Portfolio value). All three terms IIV, iNAV and IVOP are used by market data providers and represent the same calculation. This value is calculated the same way the NAV is calculated but it’s done every 15 seconds throughout the day and uses the current price of the assets as opposed to the previous day closing price. According to Abner (2016), “This number is designed to give investors and traders an almost real-time indication of the value of the assets underlying the ETF throughout the trading day.”. Ideally, this value would be the same as the quoted trading price of the ETF but, timing plays a role here due to the speed of markets these days.

Wrapping things Up

NAV is an important metric for investors to understand when making investment decisions about ETFs. It can help investors determine the value of an ETF, measure its performance, and calculate their capital gains tax, fees, and expenses. Investors should also be aware of other notable ETF valuation metrics, such as Premium, Discount, IIV, iNAV, and IOPV.

While the market price of an ETF is typically very close to its NAV, there can be special circumstances where it may trade at a premium or discount. For example, an ETF may trade at a premium if there is high demand for it, or it may trade at a discount if there is low demand for it or if there are concerns about the underlying assets.

Investors can use NAV to their advantage by buying ETFs when they are trading at a discount and selling them when they are trading at a premium. However, it is important to remember that NAV is just one factor to consider when making investment decisions. Investors should also consider the ETF’s investment objective, fees, and expenses, as well as their own risk tolerance and investment goals.

*Abner, David J.. The ETF Handbook : How to Value and Trade Exchange Traded Funds, John Wiley & Sons, Incorporated, 2016.

Discover more from

Subscribe to get the latest posts sent to your email.