In this post, I decided to explore interest rates, focusing on loans, and borrowing. For some people, the interest rate subject can seem complex and hard to understand, which is understandable. The goal of this post is to try and simplify the more complex aspects of interest rates. For example, what is APR, and what is the difference between simple and compounding interest rates, variable vs fixed rate loans? It doesn’t matter if you’re you’re a seasoned borrower navigating complex loans or a first-time loan applicant just dipping your toes into the financial pond, understanding interest rates is your equalizer. With this knowledge, you can make informed decisions, and unlock financial opportunities, in any economic climate.

APR

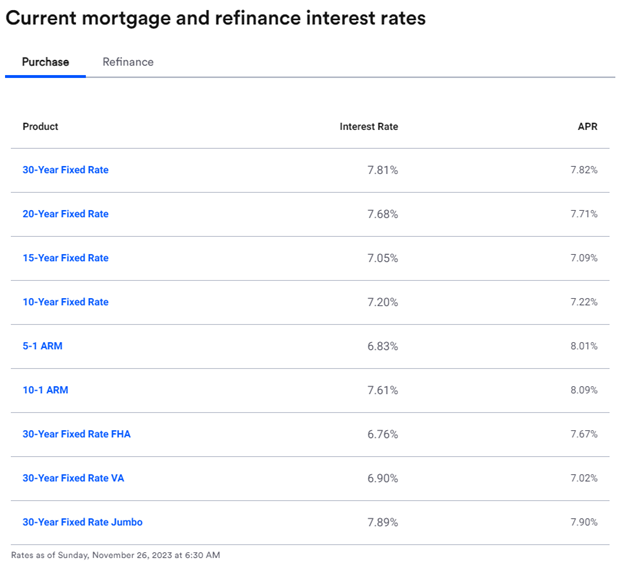

So, what is APR? APR is the yearly cost of borrowing including fees, expenses, and interest rate. APR will be listed as a percentage like 5%, 10%, or whatever percent is being offered by the lender. When looking for auto loans, credit cards, or mortgage loans APR is listed. In fact, lenders are required to provide you with disclosures that include details about the APR before you sign on the dotted line. It’s part of the TILA Act (Truth in Lending Act). Below is an example of mortgage rates that include both the Interest rate and APR. As you can see from the image the Interest rate and the APR are slightly different numbers. In each case, the APR is higher than the Interest rate due to the fees and expenses added to the calculation. One thing to be mindful of is that not all fees will be included in the APR, so be sure to check with your lender for a complete breakdown.

Simple & Compounding Interest

Simple interest and compounding interest are two different methods of calculating the interest owed. Some loans require you to pay simple interest while others require you to pay compounding interest. You should at least see which interest calculation method your loan uses when you read through the loan documentation or are advised by the lending officer. If the loan interest calculation method is simple, you will only pay interest on the original loan amount or the initial principal. Regardless of the loan amount or the interest accruing, you will only pay interest on the principal balance. On the other hand, If the loan interest calculation method is compounding, you will pay interest on the original loan balance, and any interest accrued not yet paid. The difference in interest calculation method will result in you paying more over the life of the loan with compounding compared to what you would pay if the calculation method was simple. Below you will find an example of a 3-year loan for $1,000 loan with a 20% interest rate using both interest rate calculation methods.

Simple Interest

- Principal (P): $1,000

- Annual Interest Rate (r): 20% or 0.20 (as a decimal)

- Time (t): 3 years

The formula for simple interest is I=P⋅r⋅t:

I = 1,000* 0.20*3 = $600

So, the total amount repaid over the life of the loan would be $1,000(Principal) + $600 (Interest)= $1,600.

Compound Interest

- Principal (P): $1,000

- Annual Interest Rate (r): 20% or 0.20 (as a decimal)

- Number of Compounds per Year (n): Let’s assume it’s compounded annually, so n=1

- Time (t): 3 years

The formula for Compounding Interest is A=P(1+nr)nt

- A = 1,000 (1+10.20)1⋅3

- Now, simplify the fraction inside the parentheses:

- A = 1,000 (1+0.20)3

- Combine the terms inside the parentheses:

- A = 1,000×1.203

- Calculate the exponent:

- A = 1,000×1.728

- A= 1,728

- So, the total amount repaid over the life of the loan would be $1,000(Principal) + $728 (Interest)= $1,728

Variable & fixed Rate Loans

Another important aspect of interest rate you should understand is whether your loan rate will be fixed or variable. Knowing the difference will save you time & money. Fixed-interest rate loans are characterized by a constant interest rate that stays the same throughout the entire loan term. On the other hand, variable interest rate loans (Also called an Adjustable-Rate Loan or ARM) are characterized by an interest rate that can change periodically. Your loan type will determine the timing of the periodic rate change and can change monthly, quarterly, yearly, etc. Some of the most popular variable rate loans are the 2-year and 5-year adjustable-rate mortgages offered to home buyers. Let’s look at an example of the loan types.

Variable Rate Loan Example

- You take out a 30-year variable-rate mortgage for $200,000 with an initial interest rate of 4%.

- Your monthly payment will be $989.81.

- If interest rates rise to 6%, your monthly payment will increase to $1,142.82.

Fixed Rate Loan Example

- You take out a 30-year fixed-rate mortgage for $200,000 at an interest rate of 5%.

- Your monthly payment will be $1,025.34.

- Even if interest rates rise to 7%, your monthly payment will remain the same.

Understanding interest rates empowers you to make informed borrowing decisions, unlock beneficial opportunities, and navigate the complexities of any economic climate. This article has hopefully shed light on some of the key concepts. Remember, knowledge is your best defense against financial uncertainty. So, equip yourself with the tools needed to make smart borrowing choices!

Discover more from

Subscribe to get the latest posts sent to your email.