By John Benjamin, Last updated 9/30/2024

For every investor utilizing the stock market to generate a return on their investment, one major detail to consider is fees. Fees will cut into your return and can be relatively ambiguous. This is one area we as investors should probably dive deeper into for a greater understanding, more clarity, and better returns on our money. With that being said let’s dive into the dynamic world of investment fees.

Most Common Fees Investors Pay

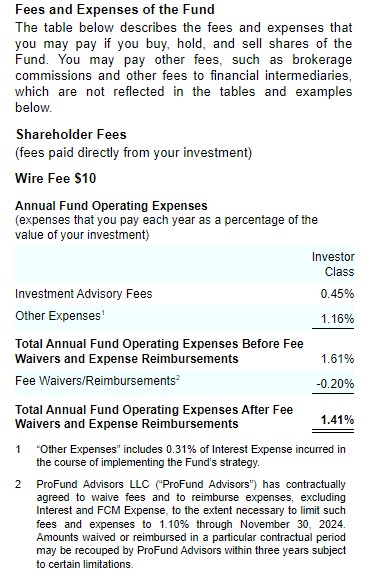

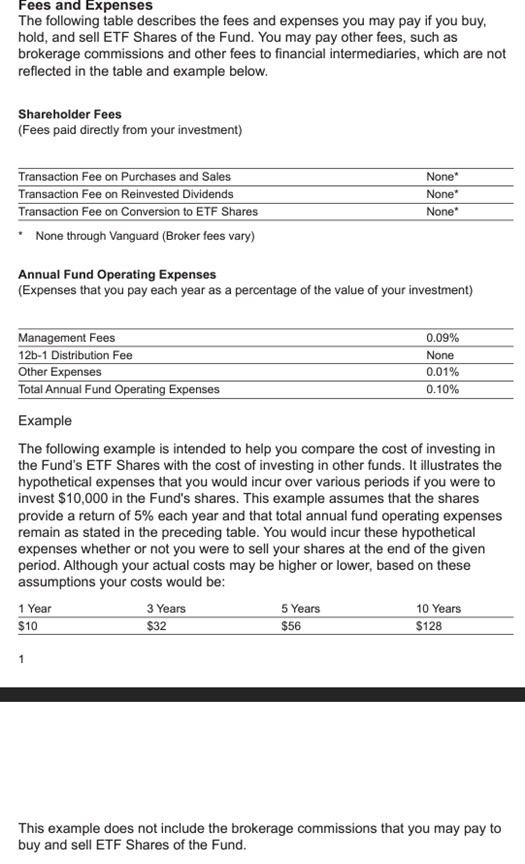

Expense Ratios: If you invest in an ETF or mutual fund you will most likely pay an expense ratio. Depending on the service you use you should see the expense ratio displayed with the price quote. Some services will break down the expense ratio on a separate tab or page. According to investor.gov, the expense ratio is an expression of a fund’s “total annual operating expenses, including management fees, distribution fees, and other expenses, expressed as a percentage of average net assets.”

- TAOE (total annual operating expenses) =500,000

- ANA (Average Net Assets)= 100,000,000

- Expense Ratio = (500,000/100,000,000)=(.005) =0.5%

- Amount Invested = 1000

- Amount you will pay yearly = (1000*.5%) =5

Management Fees: These are paid to the managers of your investment fund. It’s presented as a percentage of assets under management (AUM) or the value of all investments currently being managed by the Fund. Management Fees cover all the expenses that are assessed to the fund.

Advisory Fees: Advisory fees are assessed if you use a financial advisor or an investment manager. The fees can be a percentage of your account value or a flat fee. The fee will differ for most advisors but, the advisor should clarify this when the relationship is established.

Front-End Load Fees: Investors pay a front-end load fee when they purchase shares in some mutual funds. It’s called a front-end load fee because it’s paid on the front end when the trade is made. The Front-end load fee will be a percentage of your total investment. According to Investopiedia.com, the fee will range anywhere from 3.5% to 5.75%.

Back-end Load Fees: Investors pay Back-end load fees when they sell shares in some mutual funds. They are called back-end load fees because they are assessed when you sell your shares. You might see this fee called an exit fee or a back-end sales charge. The fee will be a percentage of your total investment. Sometimes the total back-end load fee will depend on how long you have been invested. The longer you have been invested the lower your back-end load fee will be. If you have been holding your investment long enough it could eliminate the fee.

Performance fees: Additional charges based on the fund’s performance, usually a percentage of profits above a predetermined benchmark. This fee is charged by mostly hedge funds. The fee can be charged on gains the fund makes or income the fund makes. Performance fees may be subject to a high watermark or a hurdle rate. The highwater mark or hurdle rate is a rate of return, income level, or NAV ( Net Asset Value) that the fund needs to reach for the performance fee to take effect. Most of the time you can find performance fees listed in the investment account agreement and the expense ratios list.

12b-1 Fees: The 12b-1 fee is a fee charged by mutual funds. It covers distribution and marketing. The fee also covers the fund’s operational activities or fund services. The fee can be as much as 1% of the fund’s net assets.

Where can you find the fees listed?

You can find fees listed in the summary prospectus the fund publishes. You should be able to get a copy of the summary prospectus from the fund’s website, via mail (By request), and most online websites that provide price quotes. You should see the fund fees listed in the quote given by online investment data providers.

Examples of Fees listed in Fund Summary Prospectus

Summing things up

Always know the fees before you invest. Fees could be the determining factor between making a profit and losing money. Even small differences can add up over time. Don’t be fooled by seemingly minor charges. Compare fees for different investment options & holding periods carefully. Remember, what you don’t pay in fees adds to your return growing your wealth.

Discover more from

Subscribe to get the latest posts sent to your email.